Managing False Positives in Fraud Detection & NPL Recovery with Rulex

Empowered Financial Services Strategies: Managing False Positives in Fraud Detection & NPL Recovery with Rulex

Creating value from data has become strategically crucial for helping financial services tackle both traditional and new challenges.

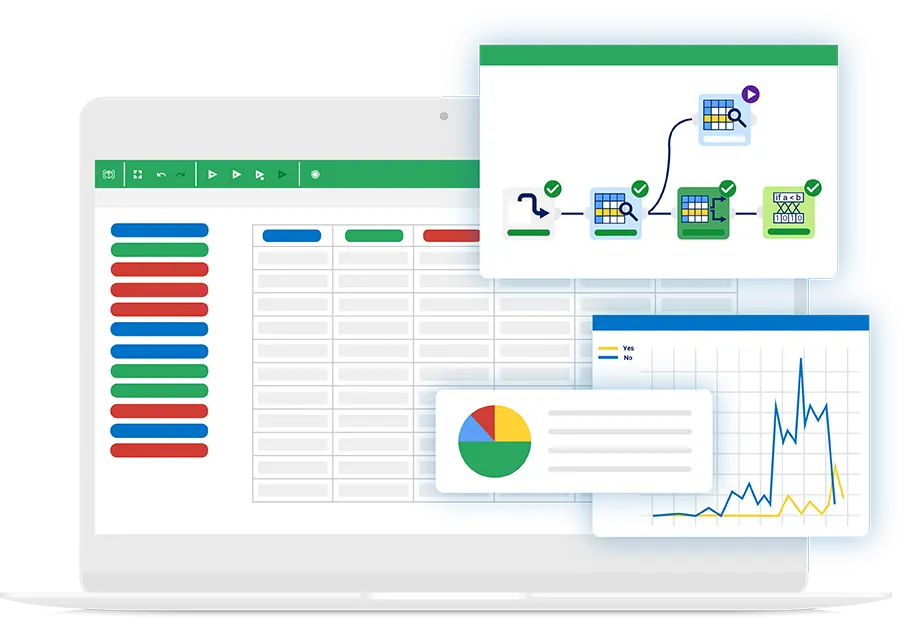

Working with major banking and insurance organizations, Rulex has developed sophisticated data-driven technology to improve financial services processes, such as managing false positives in fraud detection and non-performing loans (NPL) recovery.

Thanks to its clear and explainable technology, Rulex's financial services solutions empower business users without requiring any specific data skills and comply with GDPR and industry regulations.

Follow the courses "Managing False Positives in Fraud Detection" and "Managing NPL Recovery with Rulex" for free, directly from your laptop.

What are these courses about?

These courses give you an overview of how Rulex manages false positives in fraud detection and the recovery of NPL portfolios.

Both courses discuss the crucial role played by Rulex's eXplainable AI algorithm, the Logic Learning Machine (LLM), in the design of these solutions.

For whom are these courses?

These courses are designed for anyone who is working in the financial sector and wants to discover new, advanced solutions for fraud detection and NPL recovery.

No data skills are needed.

The courses contents:

In the "Managing False Positives in Fraud Detection" course, you'll find:

-

Fraud in numbers:

This module explains the extent of fraud in Europe (both in banking and insurance fields). -

How Rulex manages false positives in fraud detection:

This module describes Rulex's innovative approach to fraud detection, which was generated by the fruitful partnership with GFT. -

What we have done for our clients:

This module delves into a real use-case of what Rulex has done to effectively detect fraud and the tangible results achieved.

In the "Managing NPL Recovery with Rulex" course, you'll find:

-

Analysing issues related to NPL:

This module briefly explains why NPL are problematic and need new approach to fight them. -

What is different about Rulex's approach?:

This module highlights Rulex's competitive advantages in tackling NPL recovery. -

Real-life Rulex application:

This module focuses on a real use-case of a Rulex solution for financial institutions to recover NPL portfolios and the achieved outcomes.

What's next?

If you are passionate about financial services, the next free course you don't want to miss out is "Performing financial analysis", where you can learn how to manage different datasets, calculate various financial indicators (ROE, ROA, Debt Ratio) and show the results in dashboards.

Also, why not give Rulex Platform a try? Download a 30-day free trial and follow our free course "Getting Started with Rulex Factory" to get started in no time.

0 Comments

Recommended Comments

There are no comments to display.